Changing World Order

The rise and fall of global powers and where the world might be headed

Hello!

There’s so much happening in the world right now. Pandemics, wars, recession fears, Monday morning sales reviews. It’s just too scary. Things are heating up so fast, it feels like wearing a blazer on top of a sweater in mid-summer Delhi.

Such times also tend to be confusing. And honestly, it’s not beneficial to follow the news. Rather, a good mental model is “When things are going crazy, read more history and lesser forecasts”. Nobody really knows what the hell is going on, but enough shit has happened in the past to offer some guidance.

That’s why we’re going to turn to one such study and look deep into the past in order to understand our future. We’re talking about Ray Dalio’s new book ‘Principles for Dealing with the Changing World Order’. Just like the title, the book is freaking huge with enough graphs and charts to give you a headache.

So I decided to follow Rule #37 of this newsletter: “Never push a bro to read a 600-page book without providing a summary”.

That’s why I’m going to break it down into 10 key pointers that’ll give you what you need. And if you like it, go check out the other reads that made it to my H1 book recommendations list.

Now that I’ve beaten around the bush for way too long, it’s time to dive right in:

Rise and fall of major powers: One of the biggest and most interesting takeaways from the book is the pattern that one can observe in the rise and fall of dominant world powers. Each empire that rose to prominence owing to a range of factors (like investments in education, inventiveness, military strength, etc) was able to retain its status for only a couple of centuries. Moreover, the decline in the key metrics that took them to the top was paralleled by the rise of an incumbent who’d ultimately beat them and take the pole position. This has happened with the Dutch as they reigned supreme between 1625-1795, the British Empire that took over and remained in power until the early decades of the 20th century, and the American empire now- which seems to have been the owner of the world since ages…but is now looking like that dude in college who suddenly starts getting ignored by all the girls because he has herpes.

Long-term psychological cycle: This is an interesting model of how people think as countries go from poverty to peak prosperity and then back down. Initially, the people in countries that have just begun the process of rebuilding (after getting free from foreign rule or after political consolidation), are poor and act poor. This leads to a lot of savings over time. The next generation is getting rich but still acts poor (think of our parents’ generation- they may have enough money but many still wage war to save 2 rupees per transaction). Over a few more generations, this conservatism is lost and people get rich and act rich- this is when art flourishes, workweeks shorten, and it seems like everyone’s on leave 8 days a week. This leads to decadence and excesses, and over time, people start getting poor but still act rich. Finally, in the last stage, people’s prosperity takes a massive hit and they are forced to act poor- because there’s no other option.

The Internal Order Cycle: The rise and fall of powers, per Dalio, is a cyclical process and goes through 6 stages. In this point, we’re specifically focussing on the internal affairs of these countries/empires as they move through these stages. It all begins with the consolidation of power by a winning faction. This is followed by the rebuilding phase where policies are set up, investments are made and the stage gets set for a period of growth. This leads to an era of peace and flourishing where everyone’s happy and nobody gets fired for being stupid. But naturally, the party can’t last till 8 AM, and the prosperity sows the seeds of excesses. You can see that this parallels the psychological cycle quite well.

Factors contributing to the fall of powers: There are 3 classic factors that contribute to the ‘beginning of the end’ for the powers that be: bad financial conditions, big wealth & value gaps between people (that leads to a lot of nasty infighting) and a massive economic (or any other kind of) shock that acts as the catalyst for a crisis that results in them getting knocked out. Bad financial situations occur when governments have borrowed way too much money and cannot print more to pay off their debts. And since raising taxes and doing budget cuts have always led to backlashes, they’re left with very few options and end up inflating the debt away (aka hyperinflation). That’s what happened in Weimar Germany, when they had to print insane levels of money to pay off their war debts- and you needed suitcases full of cash to buy a loaf of broad.

The Dutch Golden Age: In the 1500s, European empires were busy killing each other. Long story short, the Habsburg Empire came out with a bloody nose after all that feuding while the Dutch weren’t really affected. That gave them a big advantage and allowed them to emerge as the world’s leading power in the 1600s. On the way to the top, they were the first ones to launch a publicly traded firm (The Dutch VOC) and their currency, the guilder, eventually became the global reserve currency. But soon, the good times led to excesses, which led to poor finances, conflicts and eventually, the Dutch were beaten by their old enemies, the Brits. This Bank of Amsterdam took heavy losses and there was a bank run (meaning everyone literally ran to the bank to withdraw their funds), which ultimately led to the collapse of the global Dutch order and the transition to British domination.

The British Empire: The Brits were able to copy a lot of Dutch technology and inventions and produce them at a cheaper rate, which led to their rising competitiveness in global markets. This is the fate most big powers meet with- as they become rich and powerful, they lose the very competitiveness and cost advantage that brought them to the top. But it wasn’t just the Brits who were in contention for the top position- they had to fight an equally matched French empire. It was ultimately because Napoleon bit way more than he could chew, just like us at the Barbeque Nation buffet, that the French ultimately lost out and the new world order was dominated by the British. Another reason they won out was due to their financial power + naval might.

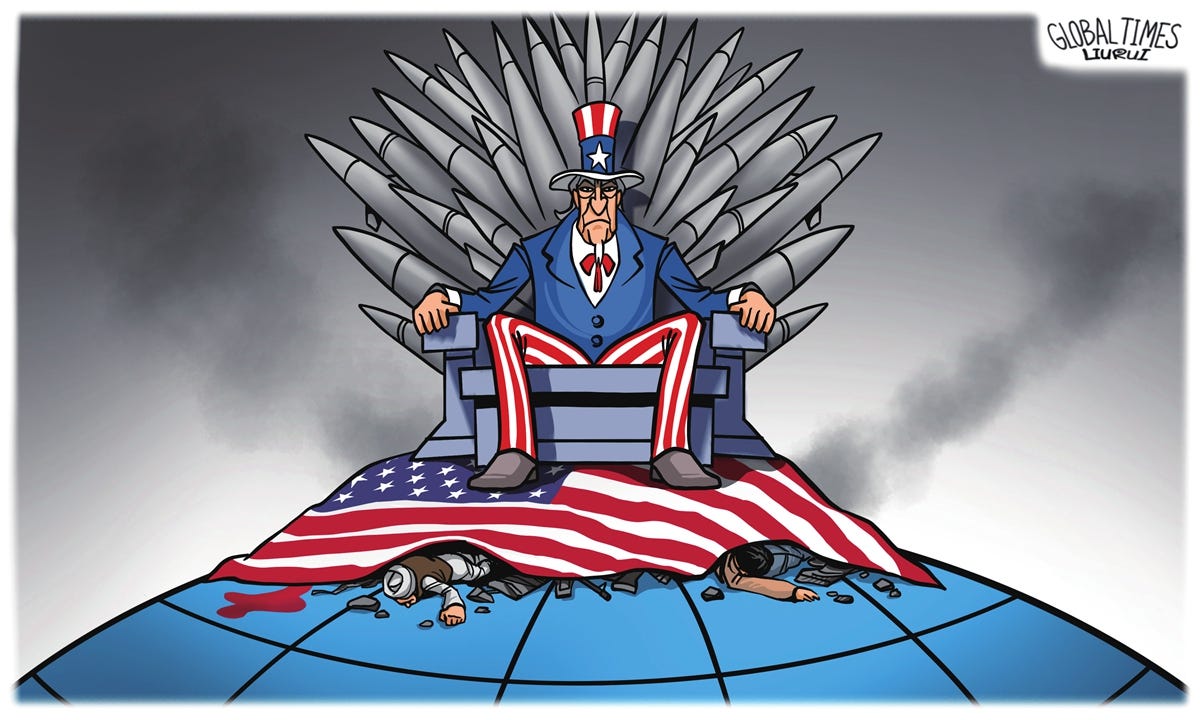

Pax Americana: The Brits may have seemed unbeatable at their peak, but problems were already brewing in the 19th Century- till the World Wars completely blew them out of proportion. Thugging around with Hitler in their little backyard bankrupted the shit out of the empire. The US took ample advantage of this brawl as they remained mostly unscathed during the war. This led to the postwar order with the US being the sole power and the Dollar the reserve currency of the world. They also lent heavily to countries wrecked by the war which gave them a good market for their goods. The influence and power compounded as America built a truly global empire, with military bases all over the world. This is the order in which we’ve been living for a while, but there are dark clouds on the horizon.

Red Dragon Rising: While the US faces the classic struggle that all global powers face due to the excesses that follow the peak (the 2008 crash was a good sign), there’s trouble on the international front. China opened up to the world under Deng Xiaoping’s leadership and began to make serious money by selling its wares to the world. They also lent money at low rates to the US which used it to buy their manufactured products- one hell of a Buy Now Pay Later deal for the Chinese. This has led to the rise and rise of China as they have become a serious power in the global political sphere. But what does the past tell us about China’s deep motivations?

The coming conflict: The Chinese are deeply hurt by the historical injustices visited upon them by the British (the Opium Wars) and the Seven Nation Alliance. They call it the ‘Century of Humiliation’ and want to do all they can to regain the glory of Imperial China by becoming a true, global superpower. What this means is that if anybody tries messing around with Chinese sovereignty (say, by calling Taiwan “independent”), they’ll fight to the death. This is a ‘red line’ for the Chinese. At the same time, the US might also support Taiwanese independence and go to war over this issue- which might lead to an insane global conflict. These tensions are giving sleepless nights to analysts and anxious millennials. We’re also seeing financial, technological, capital and geopolitical warfare already between the two behemoths- basically all 4 forms of warfare that typically precede a military war- an outcome that has a decent probability of occurring this decade. China doesn’t have what it takes to fight the big bully yet, so it’s in their interest to NOT pick this fight right away and wait for woke Americans to wreck the nation from within a little more.

Conclusion: If there’s one thing you should remember from this long-ass book, it’s the fact that the great powers come and go and nobody has been in control for more than a few centuries. The same is true for reserve currencies. These transitions are often extremely painful, and can happen even if there’s no other currency that’s ready to acquire reserve status. The classic signs to watch for (which, Dalio feels, are on full display in the US right now) are financial troubles, big wealth & value gaps and a trigger that sparks a major conflict. Keep your eyes and history books open- the next few years are going to be action packed and will hopefully pass by without bloodshed.

That’s it for today, friends. If you are into history, you can also check out last week’s piece on India before the British colonialists got to work. And if you can’t get enough of these juicy stories, just jump onto the email list and stay happy forever.